USTC Repeg: A Credible Path, A Community Plan, and How to Earn While You Wait on Uniswap (Ethereum)

USTC Repeg: Plan, Psychology & Uniswap Strategy (Ethereum)

If you’ve watched USTC for a while, you know the math is only half the story. The other half is psychology -how crowds behave when a clear narrative and a practical “what to do right now” converge. This article has two goals. First, it lays out a realistic plan the community can execute: concentrated buying, visible pledges to burn at price milestones, and a “flywheel” that uses Uniswap fees on Ethereum to deepen liquidity and compound exposure. Second, it gives you a hands-on strategy for participating today: providing liquidity to the USTC:WETH pool on Ethereum mainnet so you earn fees while helping to harden price discovery.

This piece builds on our earlier analysis of whether USTC could ever reclaim its peg. Since then, burn totals have risen, mindshare is intact, and Ethereum-side liquidity has become a meaningful lever. None of that guarantees a repeg. But together they make upward drift—and the conditions for a squeeze—more plausible than they were.

The USTC Burn Tracker shows the fair progress of a community lowering the outstanding tokens:

https://www.luncmetrics.com/burn-tracker/ustc

The simple arithmetic behind a bigger idea

Start with a thought experiment. USTC’s liquid float is measured in billions of tokens, but it is fragmented across venues and wallets. What if the community acted in a coordinated, transparent way?

- Five thousand people, each accumulating one million USTC, would collectively command five billion tokens. At today’s prices, that’s roughly $7,000 per person—substantial, but not fantasy money in crypto. Some already hold more than that; others would need time to build the position.

Why does this matter? Because visible, verifiable concentration changes crowd expectations. When buyers can point to real wallets—not memes—confidence scales. And once confidence scales, price tends to follow faster than spreadsheets predict.

Now add one more layer: pledges to burn fixed percentages at clear milestones—say at $0.10, $0.20, and $0.50—with on-chain proof. Burns don’t magically create dollars, but they permanently remove sellable units. When markets believe that burns will trigger as price rises, the anticipation itself becomes a tailwind. You don’t need every holder to pledge; a small but credible subset is enough to tilt expectations.

That credibility needs a home.

The pledge site the community should build

The missing piece is infrastructure: a public, tamper-resistant pledge page where participants can link a wallet (or sign a message) and publish:

- how many USTC they intend to accumulate,

- the burn percentage they commit to at each milestone,

- and a permissionless proof once they actually burn.

Nothing fancy: a clean table of wallets and commitments, a dashboard of cumulative pledged burns by milestone, and a “fulfilled vs pending” counter. The point is not coercion but coordination—an easy way for newcomers and press to see that USTC isn’t just a story; it’s a story with receipts.

Why Ethereum-side liquidity matters for USTC Repeg

Even if most volume still clears on centralized venues, Ethereum mainnet Uniswap is where DeFi-native capital lives. Deep, fairly priced liquidity there does three things:

- It reduces slippage for larger buys when attention spikes.

- It pays LPs—which draws patient capital that’s happy to let time work.

- It signals maturity: serious pairs on serious rails.

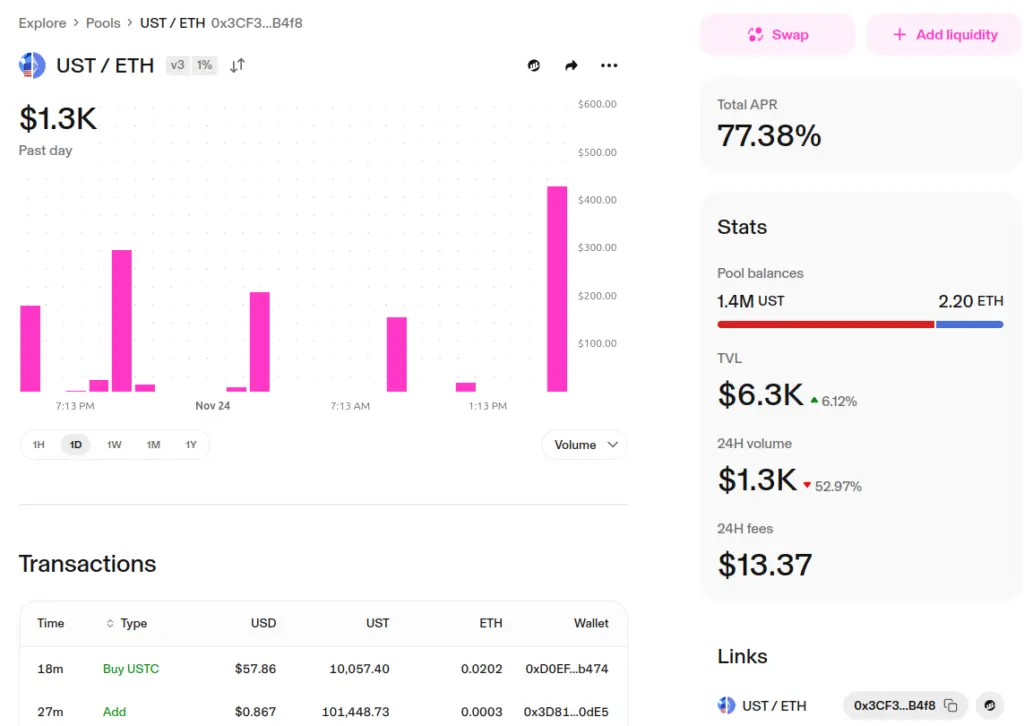

That’s where the USTC:WETH pool comes in. Liquidity providers earn trading fees when USTC flows against WETH. In quiet days, yields compress; in choppy weeks, they can jump. The important bit isn’t promising a number—it’s having a mechanism that pays you to keep the market liquid while you wait for the bigger thesis to play out.

Pool (Ethereum mainnet):https://app.uniswap.org/explore/pools/ethereum/0x3CF3D5B9061FaC75FC66bc33035803Fb067cB4f8

A human-scale walkthrough: adding liquidity in five calm steps

You don’t need to be a quant. You need a wallet, some patience, and a plan.

1) Get set up.

Install a Web3 wallet (MetaMask works), switch to Ethereum mainnet, and make sure you have ETH for gas. Fund with USTC and WETH (or just one of them—the app can route swaps).

2) Open the pool page and connect.

Use the link above. Click Provide Liquidity for USTC:WETH and connect your wallet.

3) Choose your fee tier and range.

For volatile pairs, 0.3% is a common starting point; 1% can make sense when spreads widen. Set a price range around the current price. Narrow ranges earn more per dollar but fall out of range sooner; wider ranges earn less but stay active longer. If you’re new, start a moderate range and learn how it behaves.

4) Add tokens and confirm.

Approve token spending if asked. Review the position preview, then confirm the Add Liquidity transaction. You’ll see your position appear with live fees.

5) Tend your garden.

Check in periodically. If price leaves your range, you pause earning until you reposition. When fees have built up enough to justify gas, collect and, if you’re compounding, add them back to your range or create a second, narrower band. Over time, this turns volatility into income.

That’s it. No heroics—just a repeatable process that earns when attention returns and people trade.

The liquidity flywheel: earn → buy → burn (optional) → reinvest

Here’s how the community plan and Uniswap strategy reinforce each other:

- Accumulate until you reach your personal target (whether that’s 100k, 1M, or more).

- Provide liquidity on Ethereum so your holdings help lower slippage for the next wave.

- Earn fees as volume rises when USTC features in feeds and news.

- Optional burns at milestones (per your pledge) to permanently reduce float as price climbs—announced and proven through the pledge site.

- Reinvest the rest: use collected fees to buy more USTC or to thicken your Uniswap ranges. That deepens the book for the next buyer, which attracts the next, and so on.

This is not “number go up because we say so.” It’s plumbing that rewards patience and signals that attract new capital. When people see slippage fall and liquidity rise on Ethereum, they are more willing to participate—even skeptics.

Addressing the obvious objections

“Won’t LPs become forced sellers in a rally?”

Uniswap’s constant-product math will gradually sell some USTC for WETH as price rises—that’s how fees are earned. If you want full upside during a breakout, you can always pull liquidity first or keep a portion unpooled. Think of LPing as a “get paid to wait” mode, not a permanent state.

“What if yields collapse?”

They do ebb and flow. In slow weeks, yields compress; in busy weeks they can surge. The point is not a fixed APY but a structural habit: let sideways and choppy periods pay you rather than draining your patience.

“What if nobody honors the burn pledges?”

That’s why the pledge site must require on-chain proof and should highlight fulfilled vs pending. Credibility compounds; so does the story if promises aren’t kept. Make keeping promises easy—and visible.

A realistic “USTC Repeg” vision

Picture the sequence:

- A core of early adopters reaches critical mass, publicly committing wallets and milestones.

- The pledge site starts to show real numbers: millions pledged to burn at $0.10, then $0.20. Press notices.

- During attention spikes, Ethereum Uniswap liquidity is already thick enough that bigger buyers can get in without bruising the chart. Fees jump; LPs compound.

- A few milestone burns actually happen, on-chain, on time. Those transactions are screenshotted, catalogued, and shared. The story upgrades from hope to proof.

- The next tranche of buyers arrives because the plumbing held—and because there’s a public scoreboard of commitments kept.

Does this alone guarantee $1.00? No. But it shortens the distance between narrative and reality. Burns reduce liquid float; visible commitments boost trust; Ethereum liquidity makes it easy for larger players to act. That combination is how impossible targets become at least scenario-worthy.

Practical notes and fair warnings

- Impermanent loss exists. LPs sell some USTC into strength and accumulate it into weakness. If you want to ride a violent upside, pull or narrow your range ahead of time.

- Gas is real. Batch fee claims; don’t collect $5 with $8 of gas.

- Smart contract risk isn’t zero. Stick to official interfaces and verified token addresses.

- None of this is financial advice. USTC remains a high-volatility asset. Size positions so you can sleep.

Where to click, what to share

- Pool (Ethereum):

https://app.uniswap.org/explore/pools/ethereum/0x3CF3D5B9061FaC75FC66bc33035803Fb067cB4f8 - Background piece: earlier USTC analysis

- Community tasking: If you’re a builder, start the pledge site—lightweight, open-source, and wallet-signature based. If you’re a holder, consider a public pledge (even a small one). If you’re an LP, post screenshots of fee accruals (with redactions if you prefer) to show newcomers how the flywheel works.

a self fulfilling prophency via a new hype?

USTC Repeg is not just a price; it’s a plan: 5,000 people × 1,000,000 USTC, milestone burns with proof, and Ethereum mainnet liquidity that pays its own way. The market rewards assets that look organized and feel liquid. If the community builds those two qualities in public—and keeps promises when milestones hit—the gap between here and a hard dollar narrows more quickly than most expect.

Educational content only. Do your own research.