Bitcoin surges 13% in a Single Day as FED puts temporary Halt to Interest Rate Rise

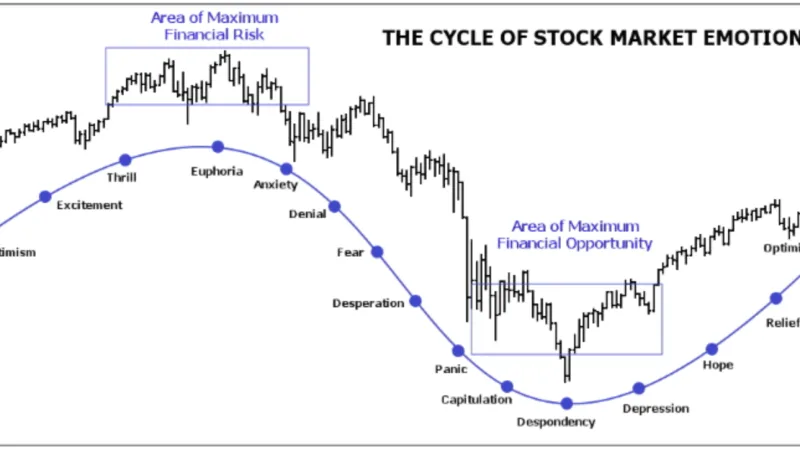

Cryptocurrency Trading Risks are happily taken by Investors

Bitcoin experienced a 13% surge, its largest one-day increase in almost a month, following moves by US authorities to reassure investors about the health of the country’s financial system. This helped to extend the cryptocurrency’s recovery from its worst week in about four months. In addition, Binance’s announcement that it would convert stablecoin funds from a $1bn industry stability fund to Bitcoin, Ether and its BNB token helped to boost confidence in the cryptocurrency market. Other crypto firms including Coinbase and MicroStrategy also saw their shares rise in response to Bitcoin’s surge.

Stablecoins and Bank Closures

Stablecoins are cryptocurrencies that aim to keep a one-to-one value with a less volatile asset like the US dollar. The collapse of Silicon Valley Bank (SVB) triggered a knock-on effect in crypto’s stablecoin market, with Circle, the operator of USDC, revealing it had $3.3bn of reserves backing the token stored with SVB. This caused USDC to slip far below its dollar peg, and sent shockwaves through the broader sector. However, by Monday morning, USDC had recovered to trade at par again. The token’s depeg triggered a huge surge in volumes on decentralized exchanges on Saturday, thanks to its outsized prominence as a trading pair on such exchanges.

Tether has been the stablecoin that has benefited the most from the ructions in crypto markets, accounting for $72.3bn of the $135bn stablecoin universe, as investors yanked $3bn from rival USDC since Friday. Investors are hesitant to pick Stablecoins they can trust, in order to balance their Cryptocurrency Trading Risks.

Silvergate Capital and Signature Bank are in Trouble

Signature Bank, one of the most prominent US crypto-friendly banks left after Silvergate Capital shut down earlier this month, was closed by New York state financial regulators on Sunday with access to funds for depositors. The spate of bank closures had unnerved crypto markets, with several major crypto companies exposed.

This is following FTX which was a popular cryptocurrency exchange that experienced a major market sell-off in November due to the collapse of trading positions. This resulted in the exchange’s insurance fund being depleted, putting the platform into insolvency. The event caused widespread panic across the crypto market, with Bitcoin and other cryptocurrencies experiencing significant price declines.

Following the incident, FTX was able to recover the funds and restore the insurance fund to its previous level. However, the event has raised concerns about the stability of the crypto market and the risks involved in trading cryptocurrencies.

In the aftermath of the FTX incident, many investors are still cautious about the crypto market. However, Bitcoin’s recent surge and the moves by US authorities to reassure investors about the stability of the financial system have helped to restore confidence in the market.

Overall, the crypto market remains volatile, and investors should exercise caution whit Cryptocurrency Tradings Risks. However, with the increasing adoption of cryptocurrencies by institutional investors and the growing acceptance of blockchain technology, the long-term outlook for the market remains positive.

What do you know about Bitcoin? Take our Quiz and Find out!

Discussion – Are you considering to buy Bitcoin or already own Bitcoin?

What are the Risks and Chances you see, what are your thoughts for the Future of Crypto?

Leave a Reply

You must be logged in to post a comment.