Bitcoin price reaches $30,000, signaling a bullish trend

Bitcoin price has been skyrocketing, hitting a significant milestone by breaching the $30,000 mark for the first time since June 10 last year. Last year, the Celsius crypto lending company froze withdrawals, ultimately leading to Bitcoin’s downfall.

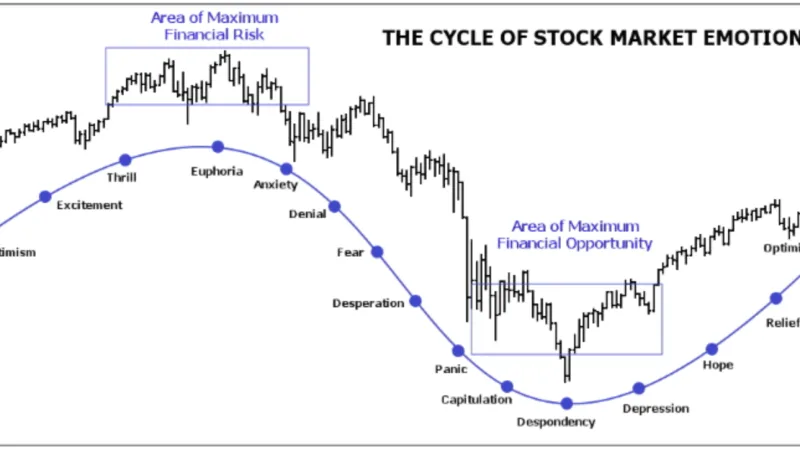

Although Bitcoin has experienced a recovery, it still has a lot of catching up to do to reach its all-time high of $68,000 in November 2021. The failure of the Terra stablecoin was a major setback. It causes a “crypto winter” in the market, leading to a significant decrease in the value of cryptocurrencies.

Bitcoin’s recent steady increase in value has sparked optimism about another potential cryptocurrency boom. Investors are keeping a close eye on this trend, hoping for a repeat of the 2017 cryptocurrency mania.

Yet, despite the enthusiasm, there are concerns of widespread manipulation in the market. The Bitcoin’s value is notoriously volatile. Additionally, the market is still largely unregulated, making it vulnerable to fraudulent activities. This could further destabilize the market.

Bitcoin price at $30,000 for first time since June last year

This surge in Bitcoin’s value is a positive sign for traders. It indicates bullish signals in the market. Most positions in the Bitcoin futures market are betting on further price increases. However, many bearish traders holding short positions already wiped out.

Many Bitcoin futures positions, including shorts, are made with borrowed money. Traders can be forcibly closed out by their brokers in a process called liquidation if prices swing the wrong way. Over $150 million in Bitcoin shorts have been liquidated since Monday (April 10). This triggered automatic buy orders that added upward pressure to an already-rising market.

Bitcoin’s recent rally can be attributed to its sensitivity to macroeconomic forces and its correlation to stocks. Although the digital assets have significantly outperformed the Dow Jones Industrial Average and S&P 500 this year.

Bitcoin’s Emergence as Safe Haven Amidst Financial Turmoil

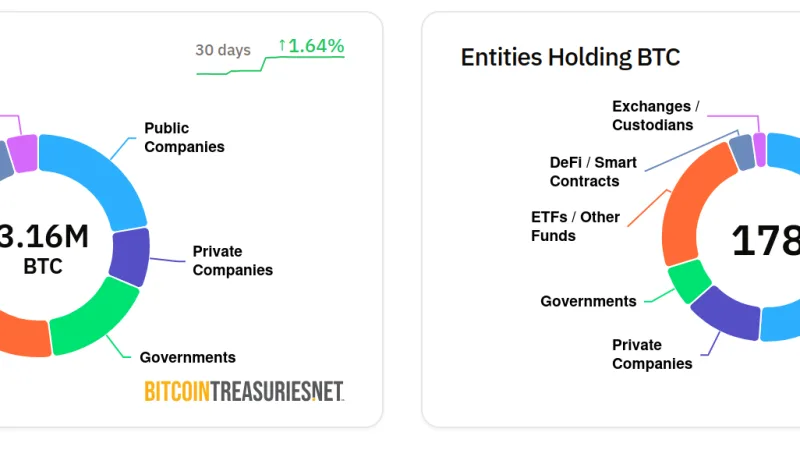

The recent collapse of Silicon Valley Bank and the resulting financial market contagion have driven cryptocurrency enthusiasts towards bitcoin. Bitcoin is the original and most valuable token in the sector, as a safeguard against the collapse of the traditional “fiat” economy. US venture capitalist Balaji Srinivasan bet $1 million in March that the price of a single bitcoin would top $1 million by June. He predicted that the US dollar would soon experience hyperinflation, causing the value of bitcoin to soar.

This is the moment that the world redenominates on bitcoin as digital gold, returning to a model much like before the 20th century. All dollar holders get destroyed.

US venture capitalist Balaji Srinivasan

Alex Adelman, is a CEO of bitcoin rewards app Lolli. He believes that April’s 10th’s rally, which saw bitcoin’s value rise from $28,000 to over $30,000, is a sign of bitcoin’s newfound bullish market conditions and strong investor confidence. The ongoing strength of bitcoin suggests that it is emerging from the “crypto winter”. In addition, it is attracting renewed interest from retail and institutional investors.

However, the dramatic recovery has raised concerns about market manipulation. Especially since there was no clear catalyst for the sudden surge in price. As bitcoin continues to experience ups and downs, it is important to remain vigilant and cautious, especially given the unpredictability of the market.